Suffolk residents and businesses lost £5.6million to investment fraud in 2024, with cryptocurrency fraud on the rise.

Data from Action Fraud reveals that people aged 35-44 were more likely to be targeted for investment fraud, while those aged 55-64 suffered the greatest financial losses.

Investment fraud occurs when criminals approach individuals, often out of the blue, and persuade them to invest in schemes or products that are either worthless or entirely fictitious. Fraudsters may claim to offer opportunities in foreign exchange, gold and other valuable metals, overseas time-shares, or cryptocurrency, promising unrealistically high returns that far exceed normal market trends.

In 2024, Action Fraud received 25,843 reports related to investment fraud, with victims collectively losing £649,062,146. While the number of reports represents a 7 per cent decrease compared to 2023, the total financial loss saw a 13 per cent increase highlighting that fewer but potentially larger scams were in operation. Cryptocurrency continued to be the most common asset fraudsters claimed to be investing in, accounting for 66 per cent of all reports - a 16 per cent increase from the previous year.

In Suffolk the more than £5.6million was lost across 233 cases.

Detective Superintendent Oliver Little, from the Lead Force Operations Room at the City of London Police, said: “Investment fraud continues to be a key focus area for the City of London because of its prevalence - which is evident from the stark figure of £649m that has been lost last year.

“It may seem obvious, but we would really emphasise the age-old ‘if it is too good to be true it almost certainly is’ mantra. Investment fraudsters will often be incredibly skilled in what they do and will spin a convincing and alluring pitch of how much money they can make you, in often a short amount of time. Do not be seduced by the promise of making “easy money” as the world of stocks and shares is anything but.

“Whether it’s £200 or £200,0000, our advice is always the same - do your research independently, check if the company is FCA registered and never take financial advice via social media or from people who have approached you out of the blue. If it were that easy to make profit on an investment, we would all know about it.”

Social media remained a key tool for fraudsters, with 36 per cent of all investment fraud reports linked to a social media platform. As was the case in 2023, WhatsApp was the most frequently used platform by scammers, appearing in 40 per cent of reports, followed by Facebook (18 per cent) and Instagram (14 per cent). Given this trend, individuals should be extremely wary of anyone contacting them via social media or messaging platforms who claims to be an investor or trader who can guarantee high returns.

The data also showed that fraudsters frequently impersonated well-known public figures to build credibility. Out of 537 reports, the most commonly used identity was Martin Lewis (44 per cent), in all likelihood due to his reputation as a trusted financial expert.

What to look out for:

Being approached via social media: the use of social media platforms as an enabler was identified in 36 per cent of the reports, with WhatsApp being the most prevalent. If you are approached, out of the blue, by someone telling you they can make you guaranteed returns on an investment, then block the number and don’t respond. For example, on Whatsapp you can do this by pressing and holding the message bubble, select ‘Report’ and then follow the instructions.

Investment opportunities that mention cryptocurrency, trading or stocks and shares: cryptocurrency and trading (unspecified) alone made up 75 per cent of all commodity types mentioned in Action Fraud reports. These two categories hugely outweigh traditional investment in commodities like natural resources (oil and gas), energy, precious metals, alcohol and forex (foreign exchange) that were mentioned in fraud reports.

An advert which uses a well-known celebrity: over £10m was lost in 2024 to fraudsters who convinced victims to invest by using an influential identity like Martin Lewis, Elon Musk or Jeremy Clarkson. AI generated images and videos were produced which helped to promote the bogus investment schemes.

How to protect yourself from investment fraud:

Investment opportunities: don’t be rushed into making an investment. Remember, legitimate organisations will never pressure you into investing on the spot.

Seek advice first: before making significant financial decisions, speak with trusted friends or family members, or seek professional independent advice.

FCA register: use the Financial Conduct Authority’s (FCA) register to check if the company is regulated by the FCA. If you deal with a firm (or individual) that isn’t regulated, you may not be covered by the Financial Ombudsman Service (FOS) if things go wrong and you lose your money.

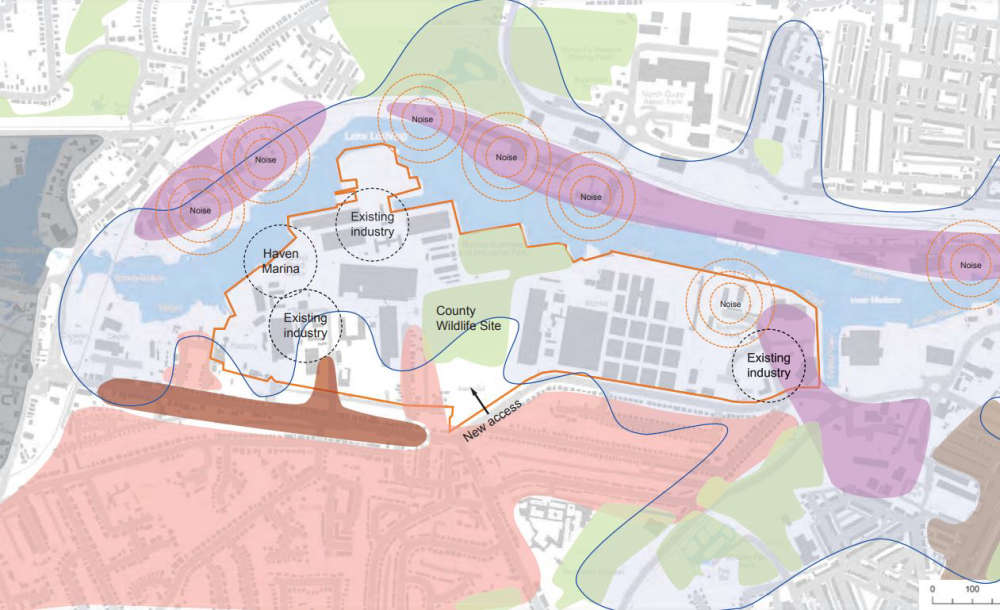

New Vision for Suffolk Waterfront

New Vision for Suffolk Waterfront

Southwold's Ukrainian Fundraiser

Southwold's Ukrainian Fundraiser

Beccles Restuarant and Bar Loses Licence

Beccles Restuarant and Bar Loses Licence

Lowestoft's First Light Festival - Fifth Year

Lowestoft's First Light Festival - Fifth Year

Beccles Charity's 40th Year Celebrations

Beccles Charity's 40th Year Celebrations

Fire Crews at Cottage Incident near Halesworth

Fire Crews at Cottage Incident near Halesworth

Sunrise Film Festival Launched

Sunrise Film Festival Launched

Teenage Boys Convicted After Pakefield Robbery

Teenage Boys Convicted After Pakefield Robbery